About Us

Our Story

Sivafinance is an

investment banking enterprise with a niche

leadership

inception

in Financial ecosystem. Since our

in 2012, we have brought in a new

approach to real estate financing in the country.

Headquartered in Kenya we have regional offices in

Ghana,Nigeria,South Africa.

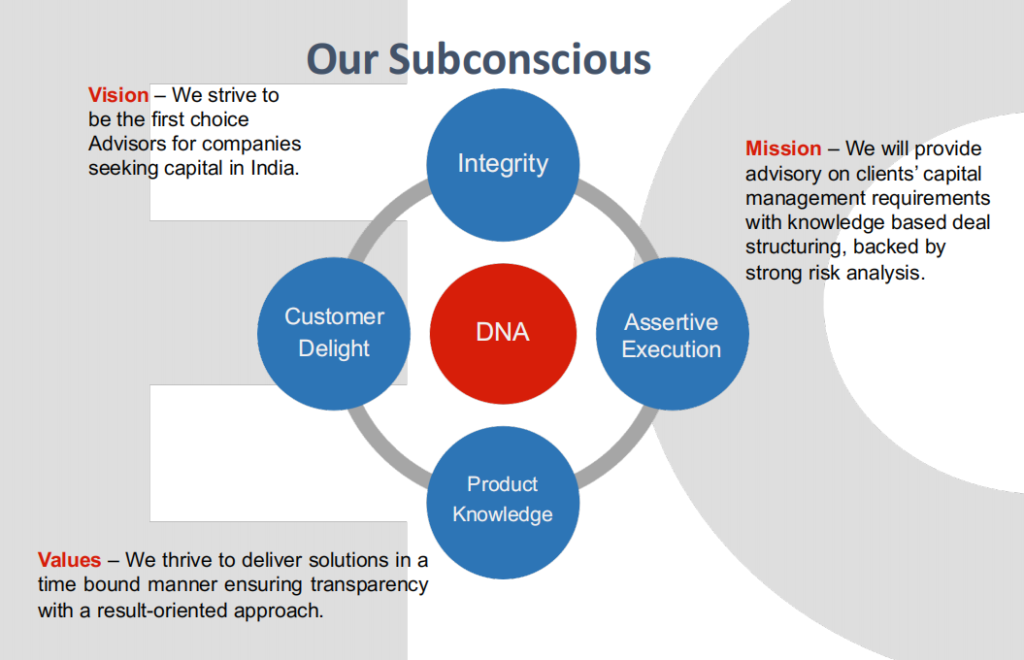

Our approach is driven by our senior management, a

group of senior ex-bankers and professionals having

an aggregate experience of more than five decades in

project finance, business banking and investment

advisory.

Our goal has always been to be the first choice

advisors for anyone seeking project capital in India.

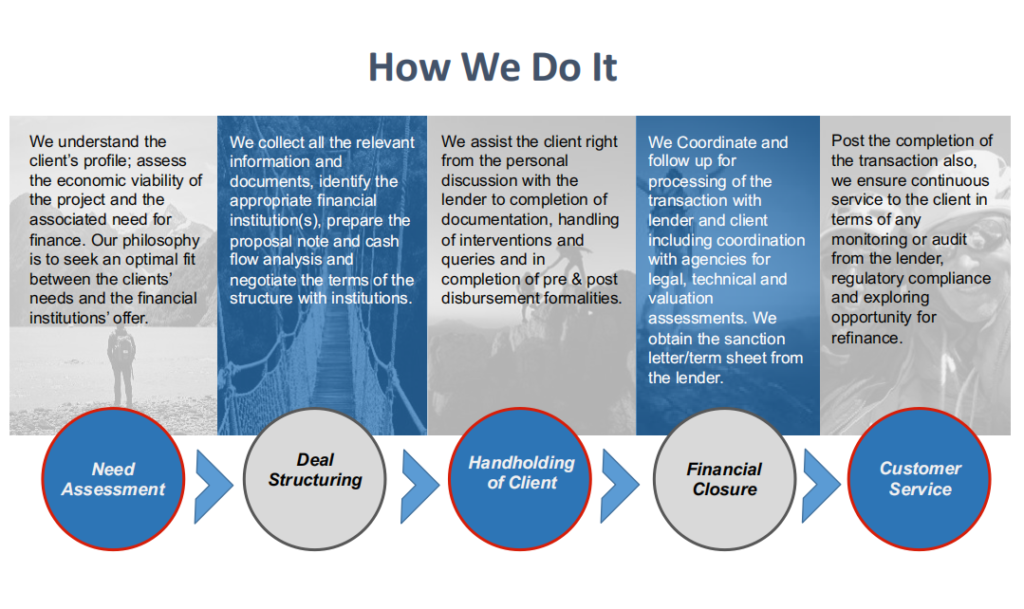

To this end, our exclusive focus is to offer our clients a

full spectrum of investment banking services including

capital raising, debt syndication, deal structuring, corporate lease financing, working capital finance,

mergers and acquisitions, private equity and research advisory.

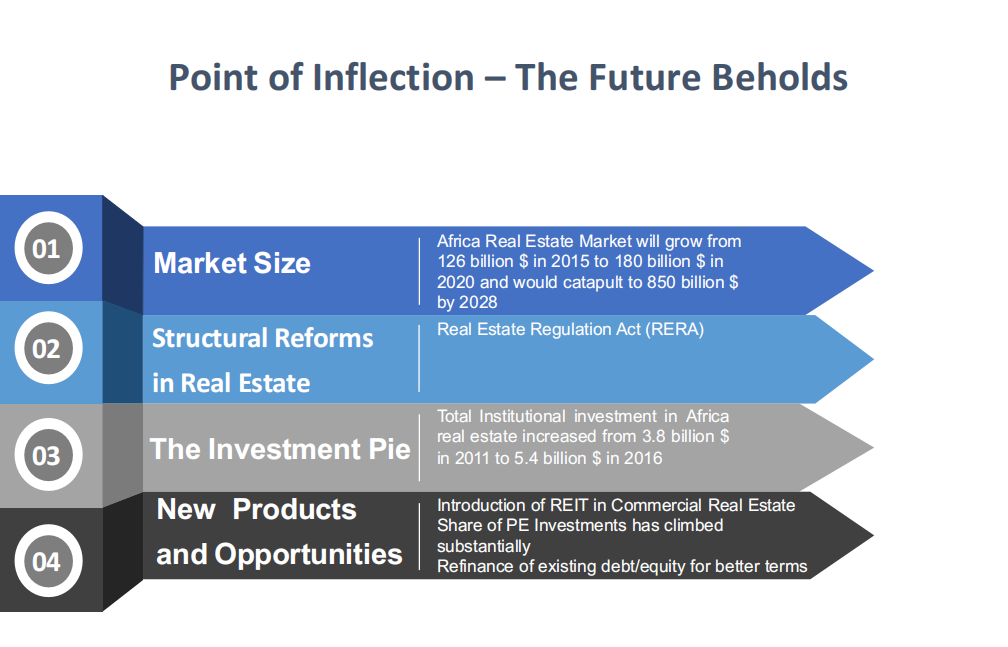

Our experience and capabilities in raising capital for

real estate and infrastructure companies is the

hallmark of our success. We have assisted our clients

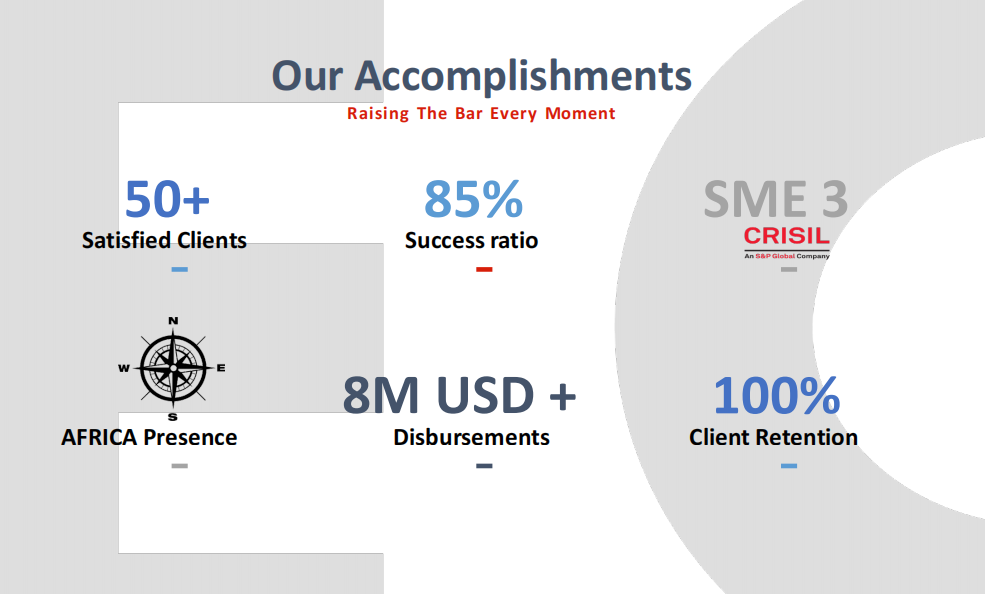

raise over USD 12M + in the last five years of our

operations. In all the transactions we have executed

till now, we have worked on independent mandates

and have had a success rate of more than 85%.

Sivafinance was founded by Dr Phil

Griffin a senior corporate and investment banker.

He is an IIM-B alumnus and FCA.

We are well networked with the top management

teams in almost all financial institutions in the country

including Banks, NBFCs and Equity Funds.

Some Milestones We Crossed

Founded

Feb 2012

• The seeds were

sown in a small

office in

Nairobi,Kenya

Spreading Wings

Dec 2016

• Moved to owned office

• Reached new geographies

• Covered 15 more lending

institutions

• Team size doubled

• Opened regional offices in

Ghana and Nigeria

First 1000 Crores

Apr 2015

• Achieved 5m usd of

disbursement

• Team size increased

to 8

Raising The Bar

Mar 2018

• Touched 9m Usd

Some Marquee Transactions

Raising The Bar Every Moment

Client: One of the top 5 developers in Kenya

Deal Size: ~ USD 900,000

Type of Financing: Structured debt

Brief: The client had an existing debt from the FIs PE firms

at higher cost. The client was seeking an exit for them and

an additional debt with extended moratorium for completion

of construction of the projects. We were able to secure a

stretched amount for the client at the best terms. We

competed with an international investment bank for this

transaction.

Client: Category A+ developer in NigeriaDeal Size: ~ USD 1m

Type of Financing: Lease Rental Discounting

Brief: The client had an existing LRD running on one of the

top performing malls in the country. We reviewed the

cashflows and all the lease agreements for the client,

identified the institutions and negotiated hard on all the

terms including the amount and the rate of interest. We

were able to clinch this deal amidst heavy competition from

foreign banks and IPCs

Client: One of the top 5 developers in

Ghana

Deal Size: ~ USD 750,000

Type of Financing: Structured debt

Brief: We arranged the structured debt over three projects

of the developer in two different transactions from the same

financial institution. This was a complex transaction wherein

there was a mix of refinance, take out, statutory and

acquisition payment and construction finance.

Client: Category A developer in South Africa Deal Size: ~ USD 950,000

Type of Financing: - Land Financing

Brief: This was a land financing transaction wherein the

existing developer was given an exit from a JV land. The

financing was given towards settling the consideration and

towards future development and construction. There were

complex legal and structuring challenges which were

resolved in this deal

Client: Category A developer in Egypt Deal Size: ~ 2.1m USD.

Type of Financing: Receivables Funding and

Construction Finance

Brief: We arranged a syndicated debt for the client’s

requirement over two projects from two financial institutions.

This transaction was done at very competitive rates within

stringent timelines as sought by the customer.

Client: A prominent Redeveloper in South Africa Deal Size: ~ 2.8m USD

Type of Financing: Construction Finance

Brief: The client was seeking a longer duration of loan for

his ongoing residential project. We got the client a stretched

moratorium along with a further top up through another

institution for taking care of approvals and construction

costs.

Client: Category A developer in Ghana Deal Size: ~ 1m USD.

Type of Financing: Structured debt

Brief: The client was seeking a refinance opportunity to give

exit to an NBFC and needed additional amount for

construction of the security on offer and some amount for

general corporate purpose. We handled the end to end

execution of transaction with ease and got them the desired

amount at the best possible terms.

Client: One of the top 3 developers in Kenya Deal Size: ~ 1.9M USD

Type of Financing: - Construction Finance

Brief: We helped the client get an initial finance at the early

stage of the project. With sustained service to the client in

terms of iterated analysis of financials and cashflows, we

have been able to arrange multiple top ups from the same

institution.